1: margin trades definition

2: margin trades work

3: margin vs leverage trades

4: example of margin trades.

Opening information:

Margin trades mean buying and selling activities with borderline or end line of something or some matter.

The selling and buying activities would happen in any place or anything, it is called trade.

So when the trade happens with a border line is called margin trade because the border line is called margin trade.

This article contains information about what is a margin trade in the stock market, how the margin trade works, and what is the difference between margin and leverage trade, and finally example of margin trade.

1: margin trades definition

People’s Investors are involved in stock trading activities, not all investors make profits, and survive their life through the stock market for their entire life.

Therefore eighty percent of the investors lose money in the stock market because there is no protection in the highest-risk places.

People who had the advantage of other Investors would have a high chance, that they wouldn’t lose the money on their Investments easily.

The advantage would be having more protection than other traders. So the money won’t get ruined in a short amount of time.

The protection line is a stop loss or buy stop sell stop or stop margin extra… But all the names are called margin.

That’s when the margin became more popular among people, each everyone started to trade with margins.

The Investor who uses the stop loss or any type of margin in the trade while buying and selling any type of Securities is called a margin trader. So let’s see how the margin trades work in the stock market.

2: margin trades work

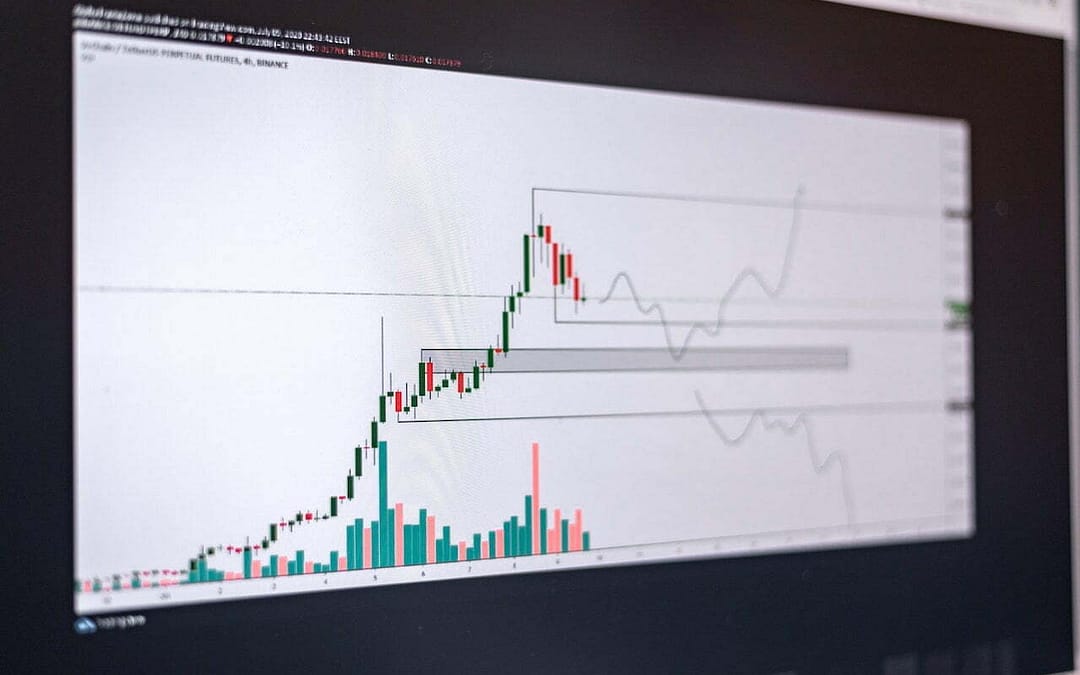

In the stock market, there are three margins in the margin trades, main margin, target margin, and protection margin.

When investors place the trade, the entry points are the main margin of every Investment. Without a main margin, there is no entry point in every investment position.

The next margin is a target margin, where the target margin is the margin of the target point to take profits or close point to finish the trade of the investment.

This target margin is used to Target certain points in investment before the stock or securities price reaches the target points.

When the price of the Securities reaches the target margin, it automatically sells the Securities and closes the margin trade of the investment.

The third margin is a protection margin. This protection line is called a stop loss margin in the margin trades.

When the stop loss is not adjusted or set in the margin trades, then the protection margin is zero in every investment.

The Investor had to adjust the margin or move the margin to their expected points, this helps the investment money to not lose the whole amount of the investment.

In margin trades, all three types of margins work together. The main margin is the important entry margin, without the entry margin trades couldn’t be placed.

But the other stop loss margin and target profit margin are set based and depend on the Investor trades.

when the Investor won’t place the top margin, the Investor risk would be high because of no margin for protection.

On the other hand, people of Investing traders confuse margin trades with leverage on the stock market, so let’s dive into what is the key difference.

3: margin vs leverage trades

Margin trades don’t have any big difference, the trades happen with three different focuses of margin would be called margin trades.

The leverage trades are not margin trades, instead when one whole investment amount multiplies into multiple amounts with borrowed money, then it’s called leverage.

So when margin trades happen

with high leverage it occupies a high risk as well as the same huge and high profits amount in trades.

The key difference between margin trades and leverage trades, is that margin trades are traded with limited points, and leverage is borrowed money with huge risk with limited points.

To make more clear about the margin trades let’s jump into one example.

4: example of margin trades.

Say Mr. Mark bought the stock F at 12 dollars. Now the main and entry margin would be 12 dollars.

Then the mark set the stop loss at 8 dollars and 20 dollars set for take profits. Now the 8 is a protection margin of the trade. Mr. Mark set the stop loss at $8 so as not to lose any more money.

The target margin is $20 because once the stock F price reaches rightly to $20 the trade will be closed in profits.

Non-Market rule: #100104

Margin trades do not come in the market rule because they are the choice to implement the trades to invest with different margins. Everyone doesn’t need to stop loss or take profit margins to profit in the investing world.

Mostly long-term investors won’t use the margin trades at all because of the long-term focus on holding one security. If your investors and not comfortable or align investing with based on market rules please learn about how to regulate your investments under your control with the use of Rule investing.