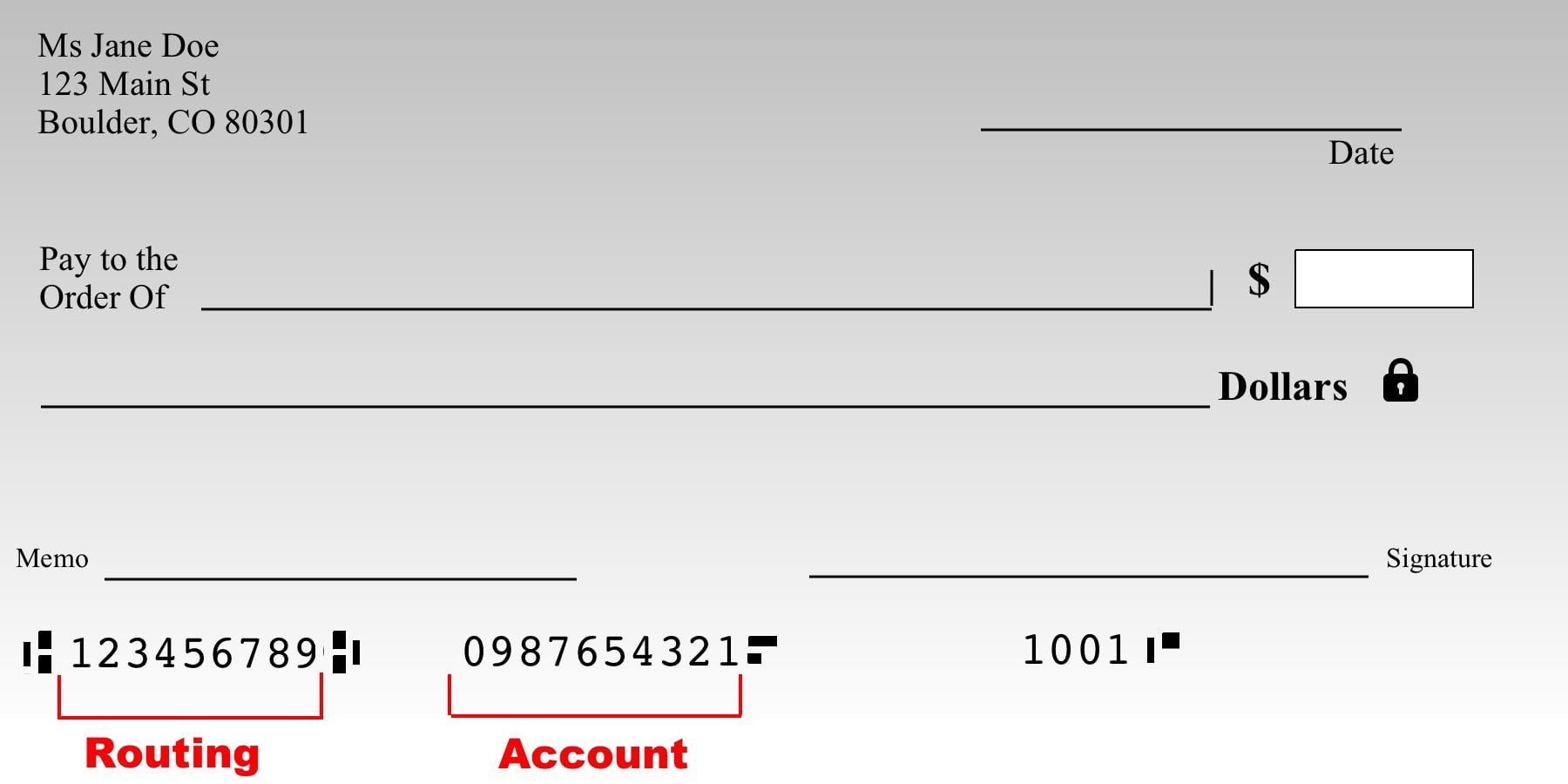

The routing number on a bank check is the American Bank Association number. which, helps to identify your bank association location.

And which can be found; on your bank account check on the bottom line left corner. however, routing numbers have two different types, one is the routing number on a bank check and an ACH routing number. which is a length of nine digits.

where I can find my routing number on a bank check

you can find your routing number on your bank association website, or you can also refer to your routing number by a bank branch.

These routing numbers are mentioned in two things, which are bank checkbooks and automated clearing houses. the routing numbers are the same in these two things.

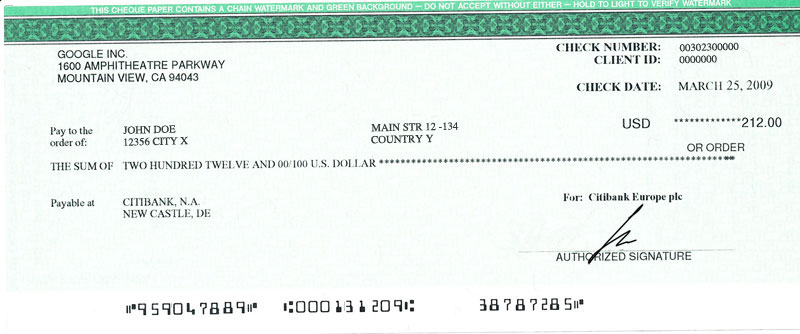

the ACH payment is an electronic transfer payment, that helps a lot of people to transfer money all over the world. it is free of cost. but wire transfers are chargeable when comparing other transfers. so you can find your routing number electronically online ways.

the checkbook is provided by the bank, which helps people to get paid through without hand cash. the routing numbers are on the bottom of your checkbook, and you can also see the account number on the right side; of the routing number on a bank check.

how routing numbers are determined.

the routing numbers are determined by the different us banks, and locations. which is chosen, and created by every particular bank. however, you can’t choose the routing numbers as you wish.

which are provided by the bank institution. when you don’t have a checkbook for your bank account, and when you want to find your routing numbers, you may easily find them by visiting your local branches.

the routing numbers determine your bank account and location, and you use banks such as Capital One, Bank of America, etc…

and which also determines your type region. this will help to make any transaction online. let’s say you affiliate marketer, and you earn a commission by selling the product; through Amazon.

you earned 500 dollars by affiliate product. when you want to withdraw your funds. you must want to give your bank account routing numbers. otherwise, you can’t withdraw your funds directly to your bank account.

so routing is used for all online payments and transactions. moreover, the routing numbers are not only issued on the checkbooks. which is used for; all types of electronic uses.

check numbers.

every check has different, and various check numbers. it can’t be the same; for all the personal bank account holders. which is found on your check at the footer, right side of the corner on the check. when you provide checks to others. which helps; the original check, was released by you.

issues on routing numbers and account numbers.

let’s say when you give the routing numbers anywhere online. then, when you make any transaction, payments (or) receive payments— through the internet. then, which will fail most of the time. sometimes it will also transfer to wrong to the wrong person.

the same thing applies to; when you give the wrong account numbers, to someone (or) some things online. then, your funds might have a chance to transfer to the wrong person (or) which also has a chance; to fail to make payments (or) receive payments. so be careful when you put the routing numbers (or) account numbers online.

Does my routing number protect my bank account?

ABA (American Bank Association). According to the Federal Reserve routing numbers and account numbers are very important to protect your bank account.

routing numbers use.

the routing numbers are; used online, through checks, banks, and to receive funds. finally, if you have any more doubts about it, then don’t hesitate, feel free to contact us.