clear definition

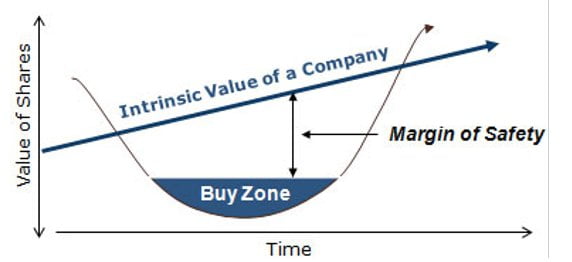

intrinsic value is the real value of the particular company. which helps people to identify, which industry is worth buying (or) not. intrinsic value is always used for investors to buy; stock at a correct value. To make money from it in the long run . so let’s take a look at one example of intrinsic value and how to calculate that.

don’t confuse this, some people call the; intrinsic value sticker price (or) stock value. but the intrinsic value is called by a warren buffet and charile Munger. you can name it as you wish. so you don’t have to confuse this.

most people misunderstand the stock price and stock value. the stock price can change every second. which is not stable at any time. but stock value changes very rarely.

you can only able to know the stock value after; when you do your calculation for intrinsic value. so now I think you may be clear about completely what is intrinsic value. let’s take a look at the calculation now.

calculation of the intrinsic value.

when you want to find the intrinsic value of a certain company. you must have to know the steps to calculate that value.

1, free cash flow.

2, estimate the discount factor

3, discount free cash flow

4, discount perpetuity cash flow

you need the free cash flow, discount factor discount cash flow, and perpetuity cash flow.

1, free cash flow

when you want to calculate the free cash flow. just subtract the current year’s operating cash flow activities amount by the plant, equipment, and property amount. which is sometimes called as also a capital expenditure (or) capex.

2, estimate discount factor

Warren Buffet is always good at buying at great discounts. so determine your discount factor. let’s say buy a 10% discount. then you will make from every dollar ten percent return every year by compound.

first year you have 1.10. second year; you have 1.21 dollars. don’t confuse yourself; in a second you want to have 1.20 dollars. this is a compound. so it makes money over money. so decide for yourself. at which percentage of discount you like to buy.

3, discount free cash flow.

for example, you decide the discount factor is 15% and the current year free cash flow is 1000 dollars.. discount free cash flow means; you can find the discount growth when buying at a certain cash flow.

if you buy at a fifteen percent discount and a thousand cash flow .then, then your first-year cash flow will be 1000+15% = 1150 Then second-year cash flow will be 1150+15% = 1,322.5, and your third year 1,322.5 +15% = 1,520.875 dollars .and find the discount factor, then divide it.

so do this for ten years. then, add every year’s cash flow together. and keep that answer of discount-free cash flow for finding the intrinsic value. but if didn’t understand clearly how the calculation works on discount cashflow. then, check out the discount cashflow article

4, discount perpetuity cash flow

perpetuity cash flow means; if the business runs for more than decades. then how much growth rates; would you get? it has you not more. but let’s say 2 to 2.5 % forever.

formula for calculating the perpetuity cash flow

DPCF = Discounted perpetuity cash flow

BYFCF = Base year free cash flow

GR = Growth rate of the free cash flow

DR = Discount rate

LGR = Long-term growth rate

DPCF=BYFCF ( 1+GR) (1+LGR)/ DR – LGR *1/ (1+DR) base year free cash flow ( 1+ average growth rate free cash flow ) ( 1+ perpetuity growth rate ) divided by the discount rate – long term growth rate (perpetuity ). then, the whole power of one by one plus discount rate.

if you do the calculation by using this perpetuity formula. then you will get the answer. if you want a real company big example. then, read this book.

Illustrated Valuations + Intrinsic Value Estimations & Bargain Hunting in the style of Warren Buffett and Charlie Munger

calculate intrinsic value

Intrinsic value = Sum of DFCF for ten years + DPCF

then, if you want to find the intrinsic value for every share. just divide the outstanding common share of the company by the total intrinsic value. finally, you will get the intrinsic value for every share.

moreover, if you didn’t understand any steps. then don’t worry; just contact me and write me. your facing which problem in finding the intrinsic value. then, I will post the new blog about particularly in your problem. now I think you may understand clearly about the intrinsic value.

who want to master all the calculations in investing like Warren Buffet, then, read my recommended books which help you master things as a stock investor.

Warren Buffett’s 3 Favorite Books: A Guide to The Intelligent Investor, Security Analysis, and The Wealth of Nations (Warren Buffett’s 3 Favorite Books Book 1)

Rule 1: The Simple Strategy for Successful Investing in Only 15 Minutes a Week!