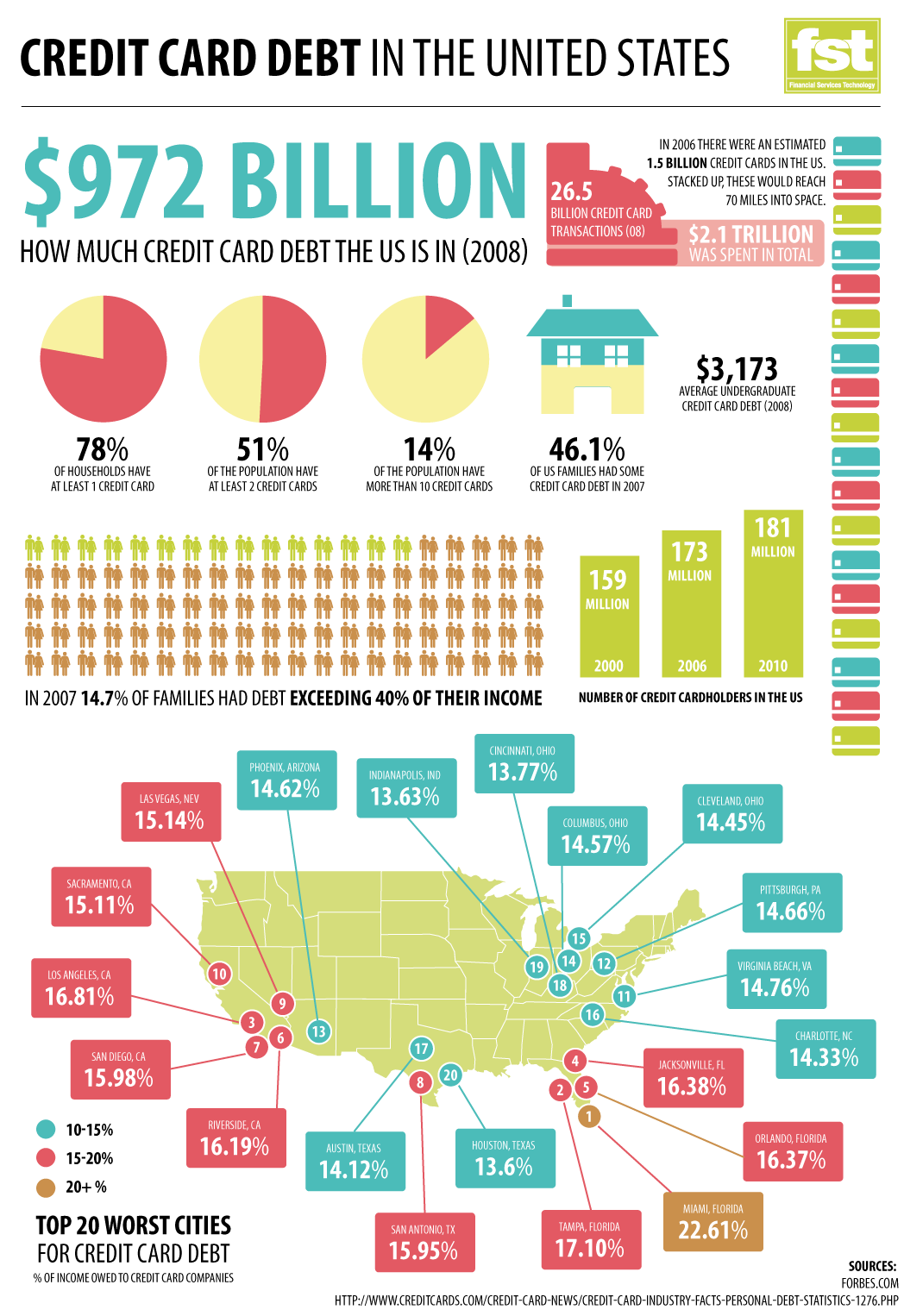

add all the credit card holders’ income, spending 50% of their income equally on credit cards is the average credit card debt in all countries.

this same method is used when you want to calculate your average credit card debt personally, but in 2019 total American’s average credit card debt was 5700$.

what happens when you have above-average credit card debt?

nowadays people are using more credit cards. take an example as an American, besides credit card debt. if you include mortgages, auto loans, student loans, personal loans, etc… American average

debt per household is 131,000$ in 2019.

when compared to all over the world, every country has different rules, regulations, and laws.

every day hundreds and thousands of people struggle to get rid of credit card debt.

when you buy Visa (or) Master credit card the normal interest rate of credit cards is 16%. however, if you didn’t pay that in the required time. your interest rate with penalty will increase up to 25%.

visa and Master card companies only have more credit card holders around the world.

visa companies have 323 million cardholders and master card companies have 191 million cardholders.

when you have above-average credit card debt, you can’t easily handle your debt because when debt is more than your average income . it affects your spending in the coming days and also your savings for the future. most credit cards used people are locked in this situation.

how do get rid of above-average credit card debt?

if you aim to get out of credit card debt. then make a perfect plan step by step.

first, pay off your highest interest rate debt instead of paying the lowest interest rate debt.

you must stick to a budget to get out of your debt. Sticking to a budget is harder and critical for a lot of people to make this work. you better make sure that your budget is faithful, you need help from your partner and family.

utilize an online payoff calculator to create a monthly payment plan. when you have more than one debt. than first pay off the highest interest rate debt.

don’t spend even 1 penny for unnecessary reasons. try to save that because every small amount can help you to pay off your debt as quickly as possible. cut off your all unwanted things until you pay off the debt.

appoint someone to hold your account until pay off your all debt. it helps you be more focused on regular savings and budget pay . even some people choose their family members (or) friends to hold they’re accounts.

when you cannot make your minimum required payment don’t be shamed because most of them face and struggle with the same issues in this world. in that case, just contacting a reputable debt relief firm will help you pay your debt

following our plan can help you to get rid of your debt step by step. moreover, you can also contact me if you have any doubts about it.

furthermore am going to provide you with some books about credit card debit. if you read any one of these books can help you to make a clear plan with worksheets and also give you full knowledge about how credit cards work.

moreover, you’ll understand how to boost your credit card score and how to free yourself from all types of debts.

1. The Debt Escape Plan: How to Free Yourself From Credit Card Balances, Boost Your Credit Score, and Live Debt-Free

2. Do-It-Yourself Bailout: How I Eliminated $222,000 of Credit Card Debt in Eighteen Months and Saved Nearly $150,000

3. How to Be Debt Free: A simple plan for paying off debt: car loans, student loan repayment, credit card debt, mortgages, and more. Debt-free living is within … Books) (Smart Money Blueprint Book 3)